The International Sustainability Standards Board (ISSB) issued its inaugural global standards. International Financial Reporting Standards (IFRS) S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures were released on June 26, 2023.

These standards provide a common language for disclosing the effect of climate-related risks and opportunities and help companies provide sustainability-related information alongside financial statements in the same reporting package.

What’s New

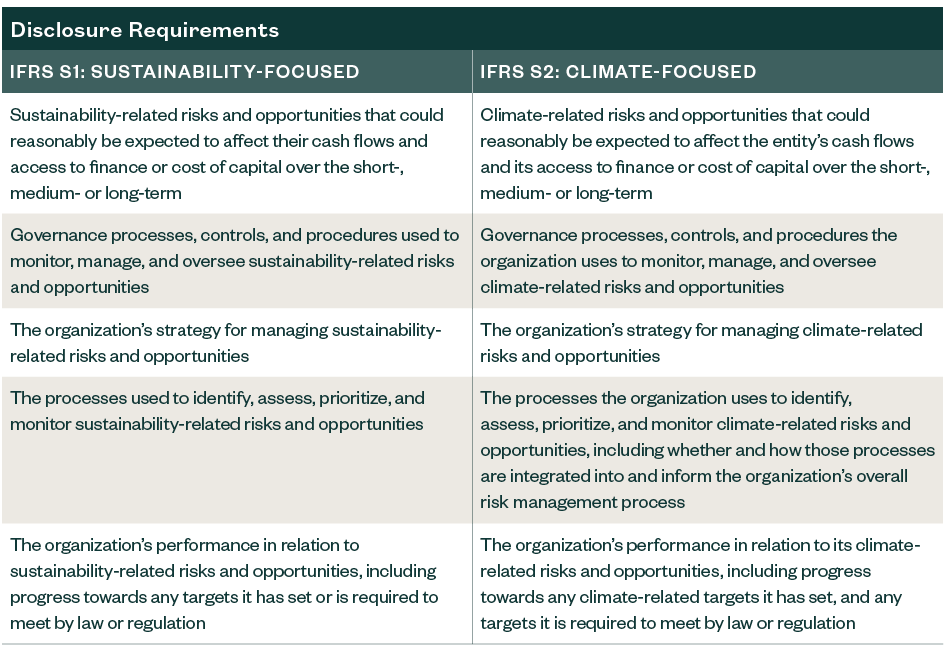

IFRS S1 and IFRS S2 provide the set of requirements below for disclosing certain information.

Included within IFRS S2’s climate-related metrics, a company is required to disclose its absolute gross greenhouse gas emissions generated during the reporting period for Scope 1, Scope 2, and Scope 3 greenhouse gas emissions measured in accordance with the Greenhouse Gas Protocol: A Corporate Accounting and Reporting Standard, unless required by another jurisdictional authority.

IFRS S1 and IFRS S2 are built on and consolidate the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, Sustainability Accounting Standards Board (SASB) standards, Climate Disclosure Standards Board (CDSB) framework, integrated reporting framework, and World Economic Forum metrics to streamline sustainability disclosures.

IFRS S1 and IFRS S2 are designed to be used together and both are effective for annual reporting periods beginning on or after January 1, 2024, with earlier application permitted.

Expected Impact

These new standards are another step toward streamlining sustainability and climate reporting and enable organizations to report on a standardized set of sustainability disclosures.

This will help reduce duplicative reporting for entities operating across multiple jurisdictions and generate decision-useful, climate-related financial information—information that’s critical for creating more transparent markets, helping achieve a smooth low-carbon transition, and building a more resilient and sustainable global economy.

Using ISSB standards is voluntary. Organizations that historically disclosed sustainability or climate data using SASB, TCFD, or who conduct financial reporting in accordance with IFRS standards will be well positioned to adopt S1 and S2 reporting.

For organizations that don’t disclose sustainability or climate data, the tenets of the S1 and S2 standards can set the basis for future reporting. For example, the SEC may consider interoperability with the new ISSB standards before releasing its climate disclosure final rule, expected in the fall of 2023.

Looking Forward

The ISSB will work to create a transition implementation group to support companies that apply these new standards and will also continue to work with jurisdictions wishing to go beyond the global baseline in required reporting disclosures.

The ISSB will also partner with the Global Reporting Initiative (GRI) to support efficient and effective reporting when the new standards are applied in combination with other reporting standards.

We’re Here to Help

To learn more about how these standards could impact you or your business, contact your Moss Adams professional.